Bad Credit Score Loans - Exactly How To Obtain Accepted

Created by-Olesen JosephsenIf you have a bad credit score, a negative credit loan can assist you get the cash you need in a pinch. While the rate of interest is normally high, a poor credit scores car loan can be the initial step toward enhancing your financial scenario. By making on-time settlements, you can improve your credit report and also make on your own a more attractive consumer in the future. These car loans are available in many kinds and also may be used to consolidate financial obligation as well as spend for emergency situations.

Bad debt individual financings are offered with a variety of lenders. Online loan providers usually have more adaptable demands as well as reduced interest rates than conventional lending institutions. Nevertheless, typical banks have physical places and can offer personal service to clients. Adding https://time.com/nextadvisor/loans/personal-loans/upstart-review/ -signer to your finance application can improve your chances of approval. However it's not the only method to obtain authorized. Below are some things you must think about before you look for poor credit scores personal fundings. Initially, be sure to check the origination fee as well as APR before approving any type of deal.

You can likewise try loaning from close friends or household. A lot of credible loan providers will be signed up in the state they run in. Additionally, a legitimate loan provider won't ask you to pay any kind of details person. Some non-reputable lending institutions will certainly ask you to pay money in advance to cover fees and also other charges. If the lender asks for cash in advance, be wary. This may be a technique designed to deceive you. Always pick a loan provider with a great online reputation and stay clear of using one with high rate of interest.

Your credit rating may likewise be an issue. While you may have an inadequate credit report, a lender may agree to overlook it as long as your credit rating demonstrates that previous problems have actually been fixed. This is particularly true if you have actually not paid off delinquent financial debt or settled insolvencies. Ensure that the old issues don't hamper your repayment of a brand-new financing. The far better your current credit report, the less threat you'll be for being denied.

Before selecting a poor credit financing, ensure you look into the customer support of the lending institution. Remember, financing repayments are pricey and also missed repayments can cause big trouble. Check the loan provider's BBB ranking to see just how it treats its clients. It's also essential to inquire about source fees. Some poor credit history personal lendings might also charge origination charges, so understand them when making your decision. Check them out and compare their prices and terms.

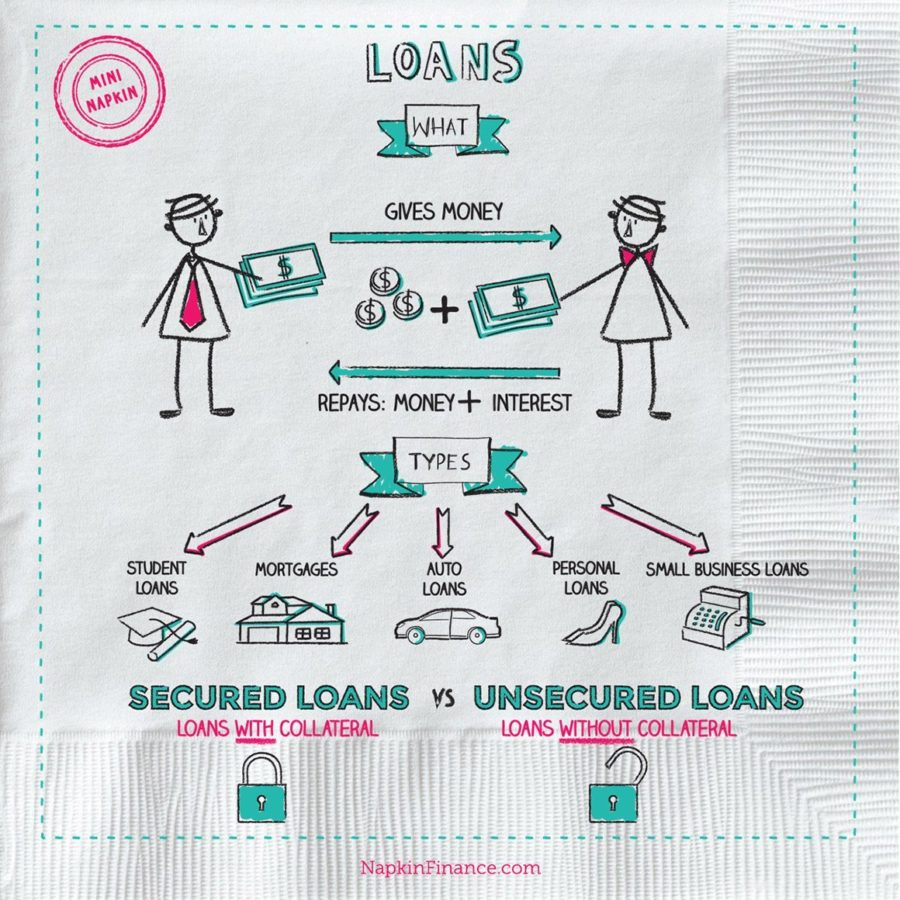

Cash advance are another sort of poor credit rating funding. This type of finance can be much easier to obtain than various other sorts of poor debt lendings. Payday advance loan, also referred to as unprotected financings, are temporary individual fundings. They can be approximately $500. Payday advance loan are typically more expensive than other types of negative credit scores fundings because of greater rate of interest. For that reason, payday loans need to be used only for short-term requirements. They can be costly since they require even more danger and also time to settle.

RadCred is a company that has actually built a network of lenders. https://www.autocreditexpress.com/blog/what-does-refinancing-an-auto-loan-cost/ with different loan providers to locate the best home mortgage prices. RadCred does not participate in the finance agreement itself. Rather, it attaches potential customers with lending institutions that can use them the very best loans at the most affordable prices. RadCred's loan provider network also uses a repayment system that's conditional or genuine. Prior to you choose, it's important to read all the disclosures as well as fine print. RadCred has actually been in business for practically a decade as well as has actually promptly turned into one of the leading banks in the sector.

If you do not have any properties to pledge as security for the loan, take into consideration requesting an unprotected funding. Unsafe lendings are easier to get approved for than safe finances, and normally supply better interest rates and also car loan limits. Nevertheless, if you are unable to make the settlements, your security can be repossessed and also your credit report damaged. Payday loans are an additional choice for consumers with bad credit scores, but these are temporary and are offered in smaller amounts. The majority of payday loans have annual percentage rates well over 200%, which are more than double the maximum rates of interest you can find on individual finances.

A lending institution needs to be signed up with the Federal Trade Commission in your state. You can discover the firm by calling your state's chief law officer or managing body. You can also get in touch with the Bbb, which ranks companies based upon issues. Take a look at the BBB's web site and also see if your potential lending institution is registered or not. A lot of legitimate loan providers do not need in advance repayment. So, ensure that you examine all this information as well as locate the very best option for you.